Car prices in the U.S. are about to climb, and according to former Ford CEO Mark Fields, it’s not a matter of speculation—it’s simple math.

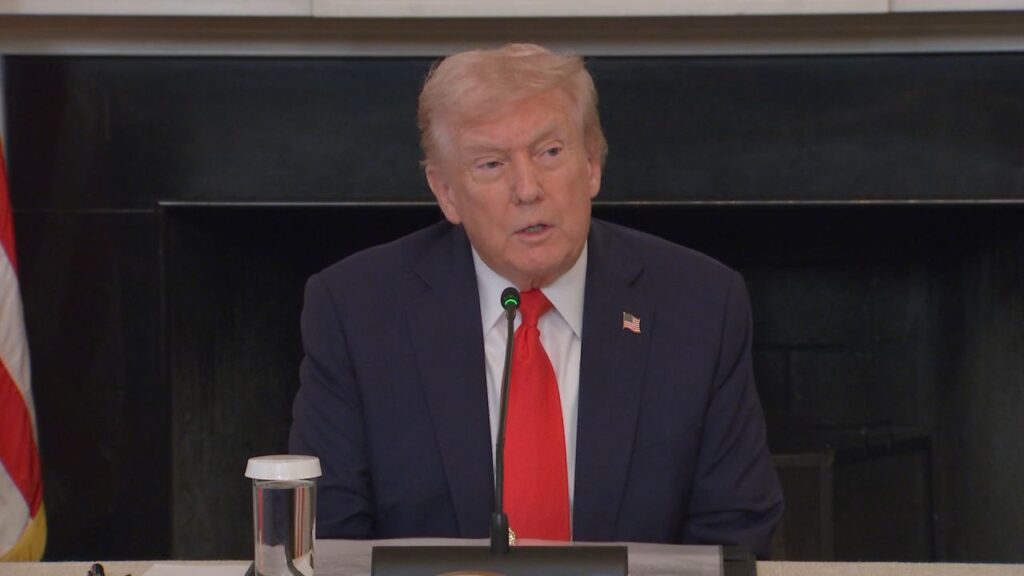

“There isn’t a single vehicle that won’t be affected by the tariffs,” Fields said, referencing the new 25% tariff on imported cars that took effect recently as part of a broader effort to bring manufacturing jobs back to the U.S. Additional tariffs on auto parts are expected by early May.

Analysts estimate that a 25% tariff on all imported auto parts could increase the cost of American-assembled vehicles by approximately $26 billion—roughly $3,285 more per vehicle. Even vehicles made in the U.S. are likely to see price hikes, as many still rely heavily on foreign components. The estimated cost increase for foreign-made vehicles could range between $5,000 and $15,000.

Fields anticipates that automakers will absorb part of the cost but will also pass along the rest to consumers, resulting in higher prices and fewer incentives. That may not sit well with buyers, who are already facing historically high vehicle prices.

Analysts warn that the price spikes could hurt demand, especially for budget-conscious buyers. If automakers pass the full 25% tariff cost to consumers, U.S. auto sales could fall by about 3.2 million vehicles—roughly 20% of the current annual sales rate. Even a partial cost pass-through of 15% could still lead to a 2.5 million unit drop in sales.

The administration has reportedly warned automakers against raising prices, though it’s unclear how that message is being enforced. Fields called such expectations unrealistic and likened them to a form of price control. “It’s very intimidating when the president says, ‘Just absorb the cost,’” he noted. “How do you put a value on upsetting the president?”

The administration argues that the tariffs will boost domestic car manufacturing and create more American jobs. However, there’s concern that falling demand could lead to production slowdowns—or even layoffs. In some areas, like Minnesota, steelworkers have already faced job cuts due to reduced orders.

The tariffs also pose risks to the broader auto supply chain. Should factories in Canada or Mexico shut down due to increased costs, U.S. suppliers may face disruptions. Analysts say this could trigger production stoppages.

To soften the blow for consumers, Ford announced it would offer employee pricing to all buyers from April 3 through June 2. This means customers can purchase vehicles at prices below the dealer invoice, potentially saving thousands and offsetting some of the tariff impact.

“We recognize that these are uncertain times,” Ford said in a statement. “Whether it’s adjusting to a changing economy or simply finding a dependable vehicle, we want to be there to support our customers.”

Reshoring Isn’t That Simple

Fields believes the tariffs will encourage automakers to bring some production back to the U.S., with estimates suggesting that companies could reduce their tariff burden by assembling about a million more vehicles domestically. But shifting production is not a quick fix. Retooling existing factories takes time and money, and building new ones can require years and billions of dollars.

Automakers are also hesitant to commit to such large investments without stable long-term policy. The frequent changes in trade policy create uncertainty, making it difficult for CEOs to plan decades ahead, as is typical in the industry.

There’s also the labor challenge. Even if new factories are built, who will staff them? Fields raised concerns about the availability of qualified workers, particularly as the workforce ages and immigration policy tightens. “Even during the slow recovery after the Great Recession, we had a tough time finding people willing to do physically demanding factory work,” he said.

In addition to hiring struggles, wages and benefits in the U.S. far exceed those in countries like Mexico, driving up production costs—another expense that could eventually be passed on to consumers.

A Win for China?

Analysts say it would be nearly impossible to bring back most auto parts manufacturing due to the high labor costs in the U.S. As a result, automakers might pivot to higher-end, higher-margin vehicles rather than affordable models, limiting access to economical transportation for many Americans.

Ironically, this could open the door for Chinese automakers to expand in the U.S. by building affordable vehicles domestically and capturing a growing segment of price-conscious buyers.

Fields believes Western automakers will bear the brunt of the trade conflict. “The Chinese manufacturers could end up being the biggest winners,” he said. “While U.S. and European automakers are bogged down managing the fallout from tariffs, Chinese firms will stay focused and keep innovating.

News Source: CNN

Bella Richardson is a dedicated journalist and news analyst known for her clear, thoughtful reporting and her ability to make complex stories accessible to a broad audience. With a Master of Science in Mass Communication, she brings both academic insight and real-world experience to her coverage of breaking news and trending topics throughout the United States.